Financial Transparency - Donations |

Our IRS mandated disclaimer says, in part, "...ReachOutGiving is not limited to, or bound in any way by, the expressed will of the donor." This statement is accurate and yet here are the donation results from January 1, 2008 through December 31, 2014:

We have received 1625 donor-advised donations - We have given 1625 donations to designated Clients*

*less Admin/Paypal fees noted below

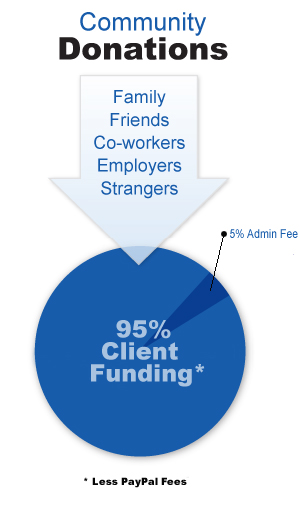

Through 2014, we have received $459,500 in donor-advised donation income. All of these donations have offered practical financial help and encouragement to our Clients. The following details will help you make donor-advised donations to ReachOutGiving with confidence:

| | | |

| | | | | | | Total Donations | | $ 34,762 | | Total Admin Deductions | | $ 1,738 | | Total PayPal Deductions | | $ 442 | | Total | | $ 32,582 | | | | | | | | | | Amt Disbursed to Clients | | $ 27,725 | | Amt Pending for Clients** | | $ 2,857 | | Total | | $ 32,582 | | | | | | | | | | Percentage to Clients | | 93.73% | | Admin Fee | | 5.00% | | PayPal Fee | | 1.27% | | Total | | 100.00% | | | | | | | | | | | | | | 2008-2014 Donations | | | | | | | | Donor-advised donations received | | 1625 | | Donor-advised donations given to Clients | | 1625 |

|

** See IRS 990. Page 11, Line 28

| |

2014 Tax Return completed by Collier Heggerness & Bronk CPA's PS

All money given to The Lighthouse Community dba ReachOutGiving is subject to the rules governing a 501(c)(3) not for profit organization. The code clearly states that all monies collected are subject to the sole discretion of the ReachOutGiving Board. Donors may suggest how their funds will be disbursed; however, ReachOutGiving is not limited to, or bound in any way by, the expressed will of the donor.

| |